Top 10 Emerging Suburbs in Sydney for Property Investment in 2025 | Property Dollar

- December 30, 2024

Sydney’s property market has long been a focal point for investors, offering a blend of stability and growth. As we approach 2025, the landscape is evolving, with emerging suburbs presenting lucrative opportunities. Leveraging insights from CoreLogic and current market trends, we’ve identified ten suburbs poised for significant growth, making them prime candidates for property investment.

1. Riverstone

- Median House Price: $890,000

- Growth Potential: Riverstone is experiencing rapid development, with new residential projects and infrastructure enhancements. Its proximity to the Sydney Metro Northwest line offers residents seamless connectivity to major employment hubs. The suburb’s transformation is attracting young families and professionals, driving demand and property values upward.

2. Oran Park

- Median House Price: $980,000

- Growth Potential: As a master-planned community, Oran Park boasts modern amenities, including shopping centres, schools, and recreational facilities. The ongoing development of the Western Sydney Airport is set to enhance its appeal further, positioning it as a strategic investment location.

3. Schofields

- Median House Price: $1,030,000

- Growth Potential: Schofields has seen substantial growth due to its strategic location between Rouse Hill and Marsden Park. The suburb benefits from significant infrastructure projects, including the Sydney Metro Northwest, which provides residents with efficient access to the city and surrounding areas.

4. Marsden Park

- Median House Price: $950,000

- Growth Potential: Marsden Park is emerging as a key residential and commercial hub in Sydney’s northwest. The suburb’s development includes major retail centres, such as IKEA and Costco, and improved transport links, making it an attractive option for investors seeking growth and rental yield.

5. Austral

- Median House Price: $860,000

- Growth Potential: Located in Sydney’s southwest, Austral is undergoing significant transformation with new housing developments and infrastructure projects.Its proximity to the future Western Sydney Airport and the Aerotropolis positions it as a suburb with substantial long-term growth potential.

6. St Marys

- Median House Price: $720,000

- Growth Potential: St Marys is set to become a pivotal transport hub with the upcoming Sydney Metro Western Sydney Airport line. This development is expected to boost property demand and values, making it a strategic investment choice.

7. Edmondson Park

- Median House Price: $990,000

- Growth Potential: Edmondson Park offers a blend of urban convenience and suburban charm. With a growing town centre, quality schools, and enhanced transport options, it appeals to families and investors alike.

8. Leppington

- Median House Price: $850,000

- Growth Potential: Leppington is a focal point of development in Sydney’s southwest, with new residential projects and infrastructure upgrades. Its strategic location near the future airport and major transport routes enhances its investment appeal.

9. Glenfield

- Median House Price: $780,000

- Growth Potential: Glenfield’s excellent transport links, including access to multiple train lines, make it a convenient suburb for commuters. Ongoing gentrification and development projects are set to elevate its property market.

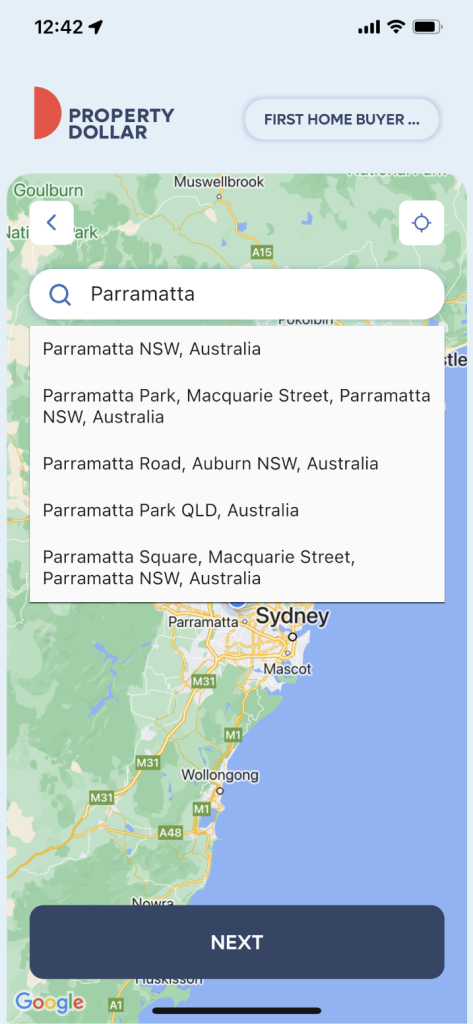

10. Parramatta

- Median House Price: $1,200,000

- Growth Potential: Recognized as Sydney’s second CBD, Parramatta continues to thrive with extensive commercial and residential developments. Its robust infrastructure, including the Parramatta Light Rail and Metro West projects, solidifies its status as a prime investment destination.

Market Insights:

According to CoreLogic, Sydney’s property market has demonstrated resilience and growth. The combined value of residential real estate in Australia rose to $11.1 trillion at the end of October 2024. National home values held steady over the October quarter, with Sydney contributing significantly to this stability. The city’s diverse property landscape offers opportunities across various price points and locations.

Investment Considerations:

When evaluating these emerging suburbs, consider the following factors:

- Infrastructure Developments: Upcoming projects can significantly enhance property values.

- Population Growth: Areas with increasing populations often experience heightened demand for housing.

- Employment Opportunities: Proximity to job hubs can drive rental demand and property appreciation.

- Lifestyle Amenities: Access to quality schools, parks, and shopping centres adds to a suburb’s appeal.

Leverage Property Dollar’s Suburb Shortlist Feature:

Navigating the property market requires access to accurate and timely information.Property Dollar’s Suburb Shortlist feature empowers investors to identify and monitor these emerging suburbs effectively. With this tool, you can:

- Track Market Trends: Stay informed about property values, rental yields, and market dynamics.

- Compare Suburbs: Analyse different areas based on key investment criteria.

- Receive Updates: Get notified about significant changes in your shortlisted suburbs.

By utilising Property Dollar’s comprehensive insights, you can make informed decisions and capitalise on Sydney’s evolving property landscape.

Conclusion:

Investing in Sydney’s emerging suburbs offers the potential for substantial returns, especially when guided by data-driven insights and strategic planning. By focusing on areas with robust growth indicators and leveraging tools like Property Dollar’s Suburb Shortlist, you can navigate the market with confidence and achieve your investment goals.

Disclaimer: The information provided in this blog is general in nature and not intended to be personalized financial advice. Please consult a financial advisor before making any decisions regarding your finances.